**Rapid Growth in Advisors Using Technology to Assist in Estate Planning**

Although the components of a “holistic” financial plan may differ from one advisor to another, estate planning remains a fundamental part of any comprehensive strategy. It is one of the eight key domains tested on the CFP exam, and for years, Kitces Research on Advisor Productivity has shown that more than 80% of advisors incorporate estate planning into their services in some capacity.

However, while most advisors address estate planning, the depth of this coverage is often minimal—limited to helping clients recognize the need for essential legal documents (such as revocable trusts, wills, powers of attorney, and healthcare directives), reviewing account titling and beneficiary designations, and referring clients to estate attorneys.

### Technology Adoption in Estate Planning

According to the recently released Kitces Research on Advisor Technology, as of 2024, only 36.5% of advisors who offer estate planning go “deep” enough to incorporate technology into that work—even if it’s just using the estate planning functionality within their financial planning software (e.g., eMoney).

That said, this picture is changing. Between 2024 and 2026, the share of advisors leveraging technology for estate planning is projected to rise nearly 10 points, reaching 46.3%.

This growth is fueled by both the adoption of traditional estate planning tools and the emergence of a newer generation of tools focused specifically on estate document preparation.

### Traditional Estate Planning Software

Traditional estate planning software helps advisors identify planning gaps, model estate flows, and visualize the implications of various strategies. In practice, Kitces Research data suggest that close to half of advisors rely on the increasingly capable functionalities of their general financial planning software (e.g., eMoney, RightCapital) for these purposes.

However, many advisors—especially those serving higher-net-worth clients—opt for stand-alone, purpose-built estate planning tools that offer Artificial Intelligence (AI)-assisted document extraction and summarizations, visual estate flowcharts, and scenario modeling for items such as estate and gift tax projections.

One such example is FP Alpha, whose market share is projected to rise from 4.5% to 5.0% between 2025 and 2026.

### Newer Generation of Document Preparation Platforms

The newer generation of document preparation platforms (e.g., Wealth.com, Vanilla, EncorEstate) brings forth a service that has existed for years in the end-consumer space but with a new angle. These systems don’t just help visualize existing plans; they also help clients complete foundational legal documents (wills, powers of attorney, healthcare proxies, and revocable trusts) within a technology environment that is marketed and used by advisors, rather than accessed and paid for directly by consumers.

Advisors who integrate such tools can take a more active role in motivating clients to complete the core estate planning documents that everyone needs, without the historical barriers to access that have existed under the traditional attorney-client model.

This service is particularly valuable for the mass-affluent demographic, where clients often engage in the estate planning process much later than is typically advisable, if they engage at all. This helps explain why the data suggest that advisors incorporating estate planning into their practices today tend to serve this segment.

—

## Concerns Advisors May Have Charging for Estate Planning

Between 2024 and 2026, roughly 1 in 10 advisors will start supporting their estate planning with technology, either through traditional planning software or through newer tools designed for document preparation. This represents either the introduction of a new service offering or, at the very least, a significant expansion of an existing one.

Accordingly, these advisors will need to decide whether to charge for these services and, if so, how to structure those fees. However, the decision of whether to charge for estate planning can be complicated by two key potential regulatory/legal risks in advisors’ minds:

1. **Avoiding the Risk of Engaging in the Unauthorized Practice of Law (UPL)**

2. **Ensuring Compliance and Clear Justification of Value for Any Fees Charged**

### Unauthorized Practice of Law (UPL)

Advisors must be cognizant that if they are not attorneys properly licensed in the applicable state, they cannot cross the line into providing legal advice. This means advisors should not personally draft legal documents, interpret statutes, give dispositive legal recommendations, or otherwise substitute their own judgment for a licensed attorney’s. Doing so could risk UPL allegations.

However, tasks such as educating, modeling estate strategies, and facilitating document creation through approved platforms (while collaborating with attorneys for customization) remain areas advisors can enter with relative safety.

For example, if an advisor tells a client, “You have an estate tax issue; you really need to establish a Spousal Lifetime Access Trust (SLAT) immediately,” that could be construed as direct legal advice and raise UPL concerns.

Alternatively, reframing the conversation in educational terms keeps the advisor from crossing the line to legal advice:

> “Given your current net worth, you have potential exposure to an estate tax liability at death. One strategy people in your situation often use is a SLAT. Here are some educational resources on the strategy, and I can help connect you with an attorney if you’d like to explore implementing the strategy.”

On the document creation side, estate planning platforms often have built-in guardrails to ensure that the client, not the advisor, controls the decision-making process. This is usually done by presenting the client with factual questions on their net worth and priorities that lead them to suitable options rather than feeding the client a direct recommendation of the documents or provisions to implement.

By bifurcating the advisor and client roles, this helps create a kind of “UPL firewall” that allows advisors to support clients and integrate strategies into their broader financial plans without crossing the legal advice line.

### Compliance, Value, and Pricing Structure

As the scope of financial planning services has expanded, regulators have increased scrutiny of how advisors charge planning fees. Advisors who charge for estate planning services must be prepared to show that these services provide clear, measurable value beyond what is already included in their typical Assets Under Management (AUM) or planning fee model.

That value might include helping to educate clients, organize and create inventories of assets and accounts, align titling and beneficiaries, complete core documents, and integrate their estate plans into their broader financial plan while collaborating with or referring to attorneys for bespoke legal drafting.

Further, even if an advisor is comfortable charging for estate planning, they must still determine how to incorporate it into their existing pricing model, and at what level.

—

## The Different Ways Advisors Can Charge for Estate Planning

Once advisors understand the regulatory boundaries around providing estate planning services, it becomes clear that charging for estate planning and document preparation—particularly when facilitated by third-party technology providers—should not constitute the unauthorized practice of law, so long as advisors stay within their lane.

Advisors already have many areas where it is prudent to help clients with estate planning. In fact, it’s part of the curriculum for obtaining both the CFP and CPWA certification.

By helping clients complete foundational documents, align ownership and beneficiaries, and connect their plan to overall financial goals, advisors can prevent costly mistakes and family disputes down the road. This proactive approach closes a well-known gap in traditional planning (with only one-third of Americans reportedly having the basic documents), and clients are often willing to pay for the peace of mind it provides.

While some advisors incorporate estate planning into their existing service offerings simply as a value-add without charging an additional fee, advisors who do choose to charge typically follow one of the following approaches:

– **Bundle into existing AUM fees**

– **Bundle into existing planning fees**

– **Add an estate planning tier to planning fee schedules**

– **Charge a flat estate planning fee**

### Bundle Into Existing AUM Fees

According to Kitces Research data, 26% of advisory firms rely exclusively on AUM fees for their revenue. These firms follow a “freemium” model, bundling pricing for their various planning services into their AUM fees—meaning the AUM fees cover both investment management and planning work.

For AUM-only firms considering the addition of estate planning services, the only way to charge for these services while remaining AUM-only is to increase AUM fees.

However, this option is likely unappealing for firms that intend to offer estate planning only occasionally, either to a specific segment of clients or as a stand-alone service, as it would require raising fees for the majority of clients who don’t use these services.

For firms planning to offer estate planning more broadly across their client base, raising AUM fees may be attractive. It allows them to be compensated for the additional service while preserving the simplicity of a single-method pricing model without adding planning fees.

By contrast, introducing separate planning fees makes the cost of services more visible. This can create challenges in prospecting, as the added fees may cause “sticker shock” for potential clients.

Additionally, existing clients may choose to opt out of these services to avoid higher costs. Such withdrawal ultimately results in less client engagement with financial planning, meaning those clients never fully experience the value of the service. Over time, this can reduce retention as clients derive less value from the advisor relationship.

Despite the appeal of bundling estate planning into existing AUM fees, many advisors struggle to raise those fees in practice.

The last two Kitces Research studies on Advisor Productivity compared AUM fees between advisors who bundle planning services into their AUM fees and those who charge separately. Crucially, the data suggest that each of these groups is equally planning-centric—both in terms of creating similarly expansive financial plans (typically covering 15 components) and in how frequently these plans are updated (half of clients had their plans updated within the last 12 months).

However, while in theory the former group should charge more since their AUM fees cover both investment management and planning, there is virtually no observed difference in AUM fees between the two pricing models whatsoever.

Simply put, advisors who bundle just charge less for the same work.

When examining firms that offer estate planning specifically, a similar pattern emerges. The typical advisor providing estate planning—whether through traditional estate planning alone or combined with document preparation (excluding firms offering only document preparation due to small sample size)—charges a blended AUM fee just two basis points higher than those offering neither service.

Taken together, while there is nothing inherently preventing advisors from raising their AUM fees, they often struggle to establish premium AUM pricing in practice.

### Bundle Into Existing Planning Fees

Another way that advisory firms charge for planning involves charging separately for these services. Advisors can do this through a variety of methods, such as hourly fees, project-based fees, or annual subscription/retainer fees.

According to Kitces Research data, 56% of advisory firms charge at least one type of planning fee, generally alongside AUM fees; although 6% of advisory firms charge only for advice (“advice only”) entirely through planning fees.

In many cases, incorporating estate planning or other types of planning services into existing pricing models does not require changes to the planning fee structure because advisors often set up fees specific to each client based on their circumstances.

As shown in the figure below [*Note: Insert relevant figure here*], in 2024, 55% of advisors offering subscription fees use case-by-case pricing.

For these advisors, estate planning can simply be one of several relevant factors when determining fees.

However, for advisors offering a single standard fee for all clients—representing 17% of those charging subscription fees and the standard model for hourly arrangements—charging for estate planning services requires raising fees if they wish to maintain a uniform fee structure.

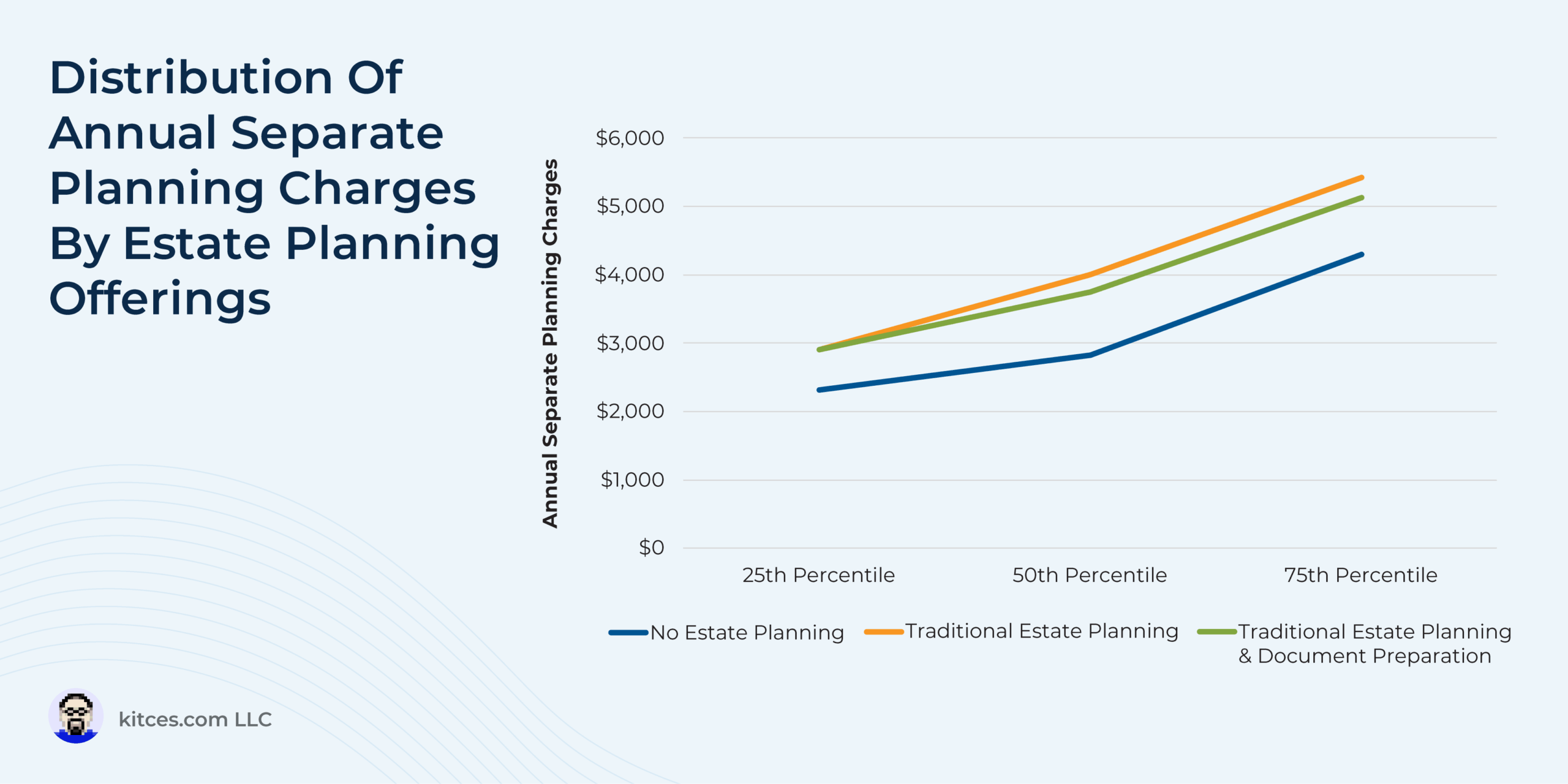

Unlike advisors who bundle estate planning into their AUM fees, those charging separate planning fees appear to collect higher fees when offering estate planning compared to those who do not.

Notably, there’s little difference in the planning fees charged by firms offering only traditional estate planning and those also providing estate document preparation. This is likely because document preparation tools primarily increase the proportion of an advisor’s clients who have an estate plan—enhancing client engagement and stickiness—but don’t necessarily add substantially to the advisor’s actual time commitment or expertise required.

This aligns with the expectation that advisors should avoid engaging too deeply in the document preparation process due to UPL concerns. Accordingly, advisors aren’t likely charging “extra” for document preparation; they are simply improving the execution of their existing estate planning service.

The more meaningful distinction lies between firms that offer any form of estate planning, which tend to charge more, and those that omit it entirely.

The size of this “estate planning premium” varies by advisor.

For those with typical (50th-percentile) annual planning fees falling between $2,750 and $4,000, offering estate planning corresponds with fees about $1,000 higher.

A similar $1,000 premium exists for advisors with higher-end planning fees exceeding $4,000 annually.

For newer or less experienced advisors charging under $2,750 per year, estate planning corresponds with a smaller increase of roughly $500 in annual fees.

### Adding an Estate Planning Tier to Planning Fee Pricing

While advisors offering estate planning services can command higher planning fees than those who do not, some may be hesitant to raise fees across their entire client base if they expect only a minority of clients to use the new service.

In such cases, advisors may prefer to introduce an additional estate planning tier within their existing pricing structure.

As noted earlier, tiered planning fee schedules are not uncommon: in 2024, 28% of advisors charging subscription fees used a tiered model.

From an estate planning perspective, fees could be layered into these tiers in two primary ways:

– Traditional estate planning support, e.g., summarizing existing plan documents, reviewing beneficiary designations and account titling, identifying planning gaps.

– Traditional estate planning support plus access to document preparation services (and ongoing amendment or maintenance access) reserved for an upper tier, with an added annual cost.

This structure allows advisors to meet clients where they are: younger clients may only request education and traditional advisor services associated with estate planning, while retirees or aging mass-affluent and/or high-net-worth families may prefer a higher-touch package that includes document completion and coordination with attorneys.

At the same time, it’s important to recognize that younger clients and those with fewer assets still need core estate planning documents. As a result, advisors may see value in providing access to at least some form of document preparation services for all clients, regardless of their life or wealth stage.

### Charging a Flat Estate Planning Fee

Advisors may also choose to simply charge a stand-alone flat fee for estate planning services.

Flat fees can be particularly attractive for advisors who want to serve clients outside their typical AUM base (e.g., adult children of clients or friends and family referrals).

This can be structured in several ways:

– **One-time engagement fees:** Used to provide services such as summarizing estate documents, organizing assets and beneficiary designations, modeling estate strategies, and offering access to document preparation tools.

– **Annual renewal fees:** Creates a recurring revenue source while delivering ongoing value. Advisors can review and summarize documents and beneficiary designations each year, and provide access to document restatements or amendments as needed.

– **Project-based pricing:** Useful for specific events or complex situations (e.g., ultra-high-net-worth estate tax reduction strategies or business succession planning).

—

## Discerning Which Charging Method Is Ideal for Your Practice

The decision to charge for estate planning depends not only on whether an advisor can do so without crossing into the unauthorized practice of law, but also on how to align the fee structure with the firm’s broader service model.

Advisors who choose to incorporate estate planning into their offerings must still determine how to price it—whether as part of an existing structure or as a distinct service.

The table below [*Note: Insert appropriate table here*] summarizes how the two primary pricing models discussed earlier—AUM-only and planning-fee-based—can be adapted when estate planning is offered broadly across all clients or selectively to only certain clients.

### Instances Advisors May Opt Not to Charge for Estate Planning

There are several cases where advisors might choose not to charge separately for estate planning:

– **Client “stickiness”:** Providing estate planning at no additional cost can be a way to cut through the typical barriers (i.e., cost, procrastination) that keep clients from engaging in the process. By making it easier to get started, advisors can increase follow-through and strengthen loyalty, especially when competing with firms that bundle multiple planning services.

– **Multi-generational engagement:** Advisors may waive fees when estate planning work leads to deeper relationships with heirs, supporting a longer-term strategy of retaining assets across generations.

– **Moving upmarket:** Offering estate planning as a value-added differentiator can help attract and retain higher-net-worth households.

Ultimately, not charging for estate planning—while perhaps less appealing in the short-term—can be a strategic decision to strengthen client relationships, reinforce an advisor’s value, and build goodwill.

### Considerations for Deciding Which Charging Method to Adopt

For advisors who decide to charge for estate planning, the first question to ask is whether these services will be integrated into the firm’s core service model for all clients or provided only occasionally to select clients (e.g., a few high-net-worth individuals within a generally mass-affluent client base, or as a stand-alone service).

If estate planning is part of the firm’s baseline service offering, advisors can avoid adding complexity to their pricing by simply raising fees across the board.

Conversely, if it will be offered on a more limited basis, a more targeted pricing structure that applies estate planning fees only to those who use the service may be more appropriate.

#### Integrating Estate Planning Into Baseline Service Standard for All Clients

For firms integrating estate planning broadly across their client base, the appropriate pricing adjustment will depend on whether they rely exclusively on AUM fees or also incorporate planning fees into their structure.

For firms charging separate planning fees, raising those fees may be an attractive option, raising the question of how much to increase them.

An earlier analysis made by Kitces Research compared annual planning fees across advisors, suggesting that firms that offer estate planning—whether limited to traditional planning or including document preparation—charge approximately $1,000 more annually than those that do not.

This difference holds true for both “typical” market rates ($2,750–$4,000 annually) and those with premium fees ($4,000+).

For firms charging less than $2,750 annually—often newer firms serving less affluent clients or aiming to attract higher-value clients—offering estate planning is associated with a more modest increase of about $500 per year.

These figures can serve as reasonable benchmarks for how much to adjust fees when incorporating estate planning into standard service offerings.

Similarly, raising AUM fees may be appropriate for firms that bundle all planning services, including estate planning, into their AUM fees.

However, as previously noted, advisors who bundle planning into AUM fees often struggle to charge premium rates in practice.

One reason may be uncertainty about how much to raise fees to reflect the added value.

While Kitces Research previously found no difference in average AUM fees between advisors who offer estate planning and those who do not, the typical $1,000 annual difference in planning fees between these groups can provide a useful benchmark.

For example, on a $1 million portfolio with a 100-basis-point blended AUM fee, this would suggest an increase to 110 basis points.

For newer advisors, where the estate planning “premium” is closer to $500, the adjustment might be closer to 105 basis points.

#### Infrequent Estate Planning

Raising fees across an entire client base—whether through AUM or planning fee increases—can be problematic when estate planning is offered infrequently, since clients who do not use the service would still see higher costs.

For firms that expect limited adoption of estate planning, a targeted approach may be more appropriate.

For firms charging separate planning fees, one approach could involve creating an estate planning tier within their existing pricing structure.

Once again, the difference between a standard tier and an estate planning tier would be about $1,000 annually, or roughly $500 for firms charging less than $2,750 per year.

For firms charging exclusively AUM fees, a targeted approach might involve simply charging a separate flat fee for estate planning services.

This ensures that only clients who benefit from the work are the ones paying for it, while still increasing overall revenue from those who opt-in.

Finally, advisors who anticipate providing estate planning services occasionally or to a select group of clients can always revisit their pricing model as adoption grows. If demand for estate planning increases, the firm may later choose to integrate the service more broadly into its baseline offering and adjust fees accordingly.

—

## Strategies for Discussing Estate Planning Services with Clients

When communicating with clients about new or expanded estate planning services, it’s important to carefully consider both tone and framing.

Estate planning is often an emotionally charged topic, and the way it’s introduced can influence how clients perceive its value.

– **If estate planning services are incorporated as a no-cost value-add**, the messaging can be relatively straightforward and positive:

> “Good news! We’ve expanded our planning services, and now estate planning services are included at no additional cost to you.”

This highlights that clients are receiving more value from the same relationship. It also reinforces the advisor’s role in protecting the client’s and their family’s financial future.

– **When estate planning is positioned as a stand-alone fee**, the framing may need to be a bit more invitational:

> “Because preserving your family’s financial future is such an important priority, we now offer estate planning as an additional service. Let’s discuss whether this new option is a good fit for you.”

This approach puts the decision in the client’s hands and clearly communicates that they are only paying for the service if they choose to use it.

– **When adding estate planning services will result in a broad fee increase across the firm’s client base**—whether through AUM or planning fees—advisors can adopt a value-based approach to communicate the change.

The goal is to shift the focus away from rising costs and toward the added value the client will receive:

> “We’ll be raising our planning fees beginning next year. While we recognize this represents a change, the increase will allow us to incorporate comprehensive estate planning into our services, giving you and your family greater clarity and confidence in preserving your legacy for future generations.”

—

## Conclusion

Offering estate planning services—whether through traditional scenario modeling or technology-supported document preparation—provides meaningful value to clients and creates an opportunity for advisors to be compensated appropriately.

By determining the right pricing structure and communicating changes clearly and empathetically, advisors can deliver added value, ensure they’re fairly compensated for the additional work involved, and confidently deliver this value within regulatory boundaries—helping clients build clarity, confidence, and peace of mind.

https://feeds.feedblitz.com/~/926521349/0/kitcesnerdseyeview~Charging-For-Estate-Planning-And-Document-Prep-Navigating-Regulatory-Hurdles-And-Real-Pricing-Benchmarks-From-Kitces-Research/