**Bitcoin and the Quantum Threat: A New Frontier in Cryptocurrency Security**

The cryptocurrency world has faced regulators, hackers, and market crashes, but its most formidable threat might come not from a trading floor, but from a lab.

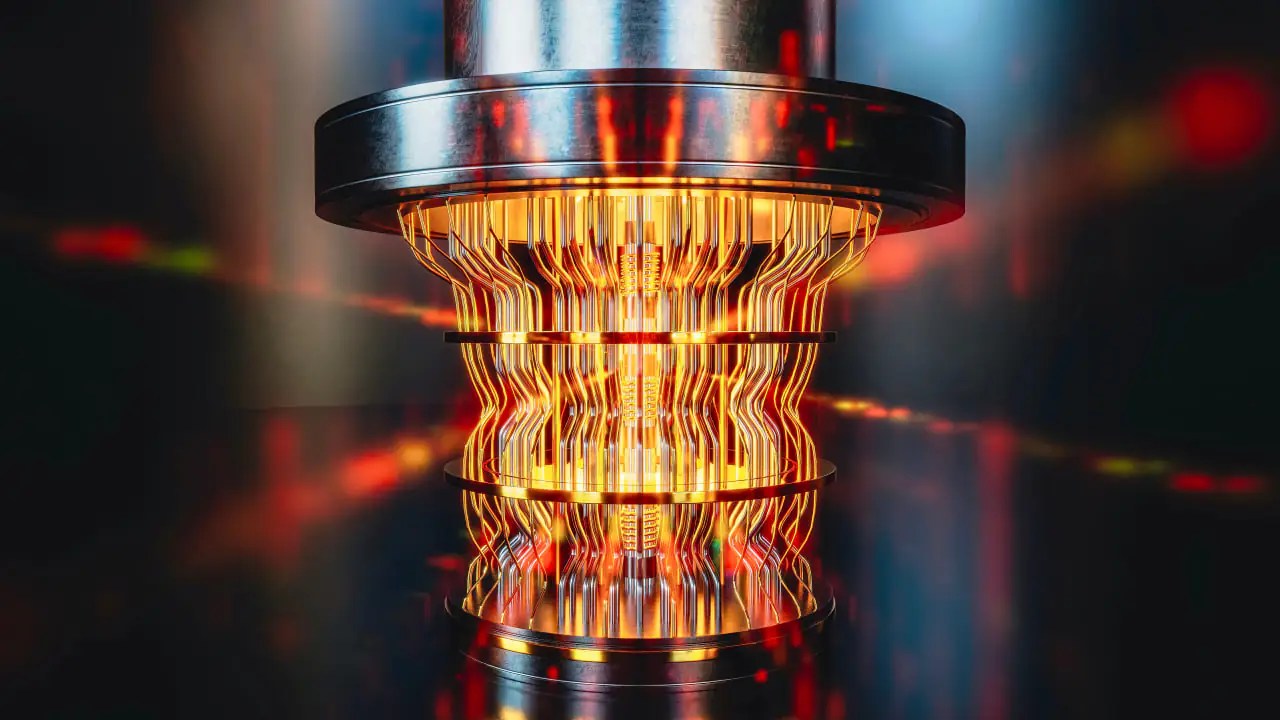

### The Machine That Could Break Math

Quantum computers don’t think like ordinary machines. By leveraging the strange principles of quantum mechanics—particles existing in multiple states at once—they can process calculations at unimaginable speeds. A computer powerful enough to fully exploit this capability could, in theory, unravel the encryption that secures nearly every digital asset in existence.

To most, that still sounds like science fiction. To others, it’s a ticking clock.

### A Venture Capitalist Looks Ahead

At the Global Blockchain Congress in Dubai, Amit Mehra, partner at Borderless Capital, described his firm’s growing focus on quantum-resistant technologies designed to protect blockchains against quantum attacks before the threat arrives. In his view, the industry has been lulled into complacency.

“When chip technology and computational power are improving this quickly, the timeline can collapse overnight,” Mehra said. He predicts meaningful breakthroughs could appear before the decade’s end, warning that proof-of-work systems like Bitcoin will be among the first to feel the impact.

### Bitcoin’s Encryption at Risk

Every Bitcoin wallet and transaction depends on cryptographic keys—enormous mathematical locks designed to be impossible to guess. Quantum computing threatens to make those locks guessable again.

A system capable of running Shor’s algorithm on a large enough scale could, in theory, derive private keys from public ones, rendering traditional wallets defenseless. If that happens, ownership itself becomes meaningless. Every coin, every NFT, every encrypted asset could be stolen or forged.

### The Alarm From the Market Side

Not everyone is content to wait for the academics. Charles Edwards, founder of digital asset fund Capriole Investments, has been sounding the alarm for months.

In a recent post on X, he claimed Bitcoin has only a short window to evolve before traditional assets like gold permanently outshine it. “It’s an emergency,” he wrote. “We have a year to choose a solution.”

His stark warning resonated because it reframed quantum risk not as a scientific debate, but as an existential business problem—one that could shape investment confidence in Bitcoin for years.

### A Quiet Arms Race in Cryptography

Some blockchain projects have already started experimenting with post-quantum encryption—new mathematical defenses designed to resist quantum decryption.

Earlier this year, SUI Research introduced a framework capable of shielding networks like Near, Solana, and Cosmos without disruptive forks or address resets. But for giants like Bitcoin and Ethereum, whose protocols are deeply entrenched, retrofitting this kind of protection would be far more complex.

Meanwhile, major governments are taking the quantum threat seriously. According to a Bloomberg report, the U.S. Department of Commerce is considering new investments in the field—not just to compete with China’s progress, but to secure America’s own cryptographic infrastructure.

### A Race Against Time

The question is no longer whether quantum computing will arrive, but when. For Mehra and other investors, the danger lies in underestimating its acceleration.

“Crypto was built on the assumption that certain problems would always be impossible to solve,” Mehra said. “Quantum computing is rewriting that assumption.”

As researchers and developers race to design a new layer of post-quantum security, the crypto industry faces its most paradoxical challenge yet: defending decentralized freedom from the very frontier of technological progress.

—

*The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.*

—

**About the Author**

Alexander Zdravkov is a person who always looks for the logic behind things. He has more than three years of experience in the crypto space, where he skillfully identifies new trends in the world of digital currencies. Whether providing in-depth analysis or daily reports on all topics, his deep understanding and enthusiasm for what he does make him a valuable member of the team.

—

**Related Stories**

https://bitcoinethereumnews.com/bitcoin/how-new-machines-could-break-bitcoins-code/?utm_source=rss&utm_medium=rss&utm_campaign=how-new-machines-could-break-bitcoins-code