**Bitcoin Long-Term Holders Ease Selling Pressure in October 2025 Amid Market Uncertainties**

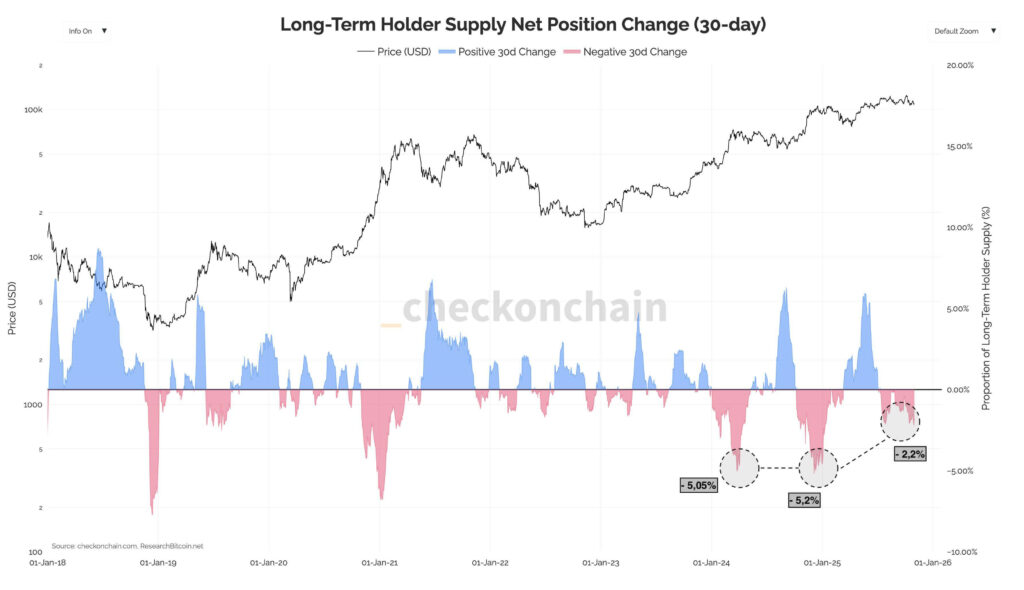

In October 2025, Bitcoin long-term holders distributed approximately 330,000 BTC, marking a softer sell-off compared to previous months. This reduction, amounting to a 2.2% decrease in their overall market supply, indicates a more cautious stance among holders amid fluctuating global conditions. This moderated selling is a notable change from earlier periods in the year when distributions reached 5% or more.

On-chain data reveals that long-term holders—defined as investors holding Bitcoin for over 155 days—play a critical role in signaling market health. Historically, accumulation phases, such as those from 2018 to 2020 when prices ranged between $3,000 and $10,000, saw these holders absorb supply and lay the groundwork for price rallies. Conversely, heavy distribution periods like early 2021 and late 2024 coincided with market peaks and profit-taking.

October’s figures suggest a trend toward stabilization. The 30-day net position change for long-term holders shifted into a milder red zone, indicating that while profit-taking continues, it is at a slower pace. With Bitcoin maintaining valuations above $100,000, this trend may reflect enduring confidence in the asset’s long-term value despite short-term volatility. Analysts from platforms like CryptoQuant note that such patterns often precede consolidation phases or renewed accumulation.

—

### Institutional Demand Slows, Affecting Market Dynamics

October 2025 also witnessed a noticeable cooling in institutional demand for Bitcoin, which contributed to overall market corrections. The Coinbase Premium Gap—a metric tracking the price difference between Coinbase and other global exchanges—turned negative for the first time in months, signaling reduced buying pressure from large institutional investors.

Several factors underpin this shift:

– Profit consolidation following Bitcoin’s surge past $100,000

– A retreat from riskier assets amid global uncertainty

– Macroeconomic signals causing institutions to recalibrate exposure

A senior analyst at Glassnode highlighted the importance of on-chain data in assessing sentiment, noting, “Institutions are adjusting based on evolving macroeconomic indicators.”

Despite encouraging developments such as the Federal Reserve’s move to wind down quantitative tightening and regulatory approvals for altcoin products, Bitcoin’s price declined in tandem with major U.S. equities. This coordination underscores the significant influence institutional flows exert on crypto valuations.

Historically, negative Coinbase Premium Gaps have preceded 5-10% market corrections, typically followed by recoveries once institutional buying resumes. Trading volumes on major exchanges including Binance and Kraken also softened during October, reflecting diminished speculative activity among professional investors.

This institutional hesitancy aligns with broader economic trends: a strengthening U.S. dollar amid mixed interest rate signals pressured crypto valuations. Meanwhile, venture capital funding for blockchain projects remained steady at about $2.5 billion for the quarter, with capital increasingly allocated to infrastructure rather than speculative tokens.

Together, these factors demonstrate Bitcoin’s ongoing sensitivity to traditional financial cycles, even as long-term holders provide a steadying influence.

—

### Frequently Asked Questions

**What does the 2.2% reduction in Bitcoin long-term holder supply mean for prices in October 2025?**

The 2.2% reduction suggests declining selling pressure from long-term holders, which may support price stability or mild appreciation. Compared to steeper 5% declines earlier in the year, this moderated distribution signals that holders are maintaining confidence amid volatility. Historically, similar on-chain patterns have limited downside risks in the short term.

**Why did institutional demand for Bitcoin weaken in October 2025?**

Institutional demand waned primarily due to the Coinbase Premium Gap turning negative, indicating diminished buying interest from U.S.-based investors. Macroeconomic uncertainties—such as Federal Reserve policy doubts and geopolitical tensions—prompted institutions to adopt a more cautious approach. Even positive developments like a U.S.-China trade truce were insufficient to sustain ETF inflows, leading to a broader pullback from risk assets.

—

### Key Takeaways

– **Easing Selling Pressure:** Long-term holders reduced their Bitcoin supply by 2.2% in October, suggesting a more cautious and stabilizing market force.

– **Institutional Caution:** The negative Coinbase Premium highlights slowed demand, emphasizing crypto’s connection to traditional market cycles.

– **Global Influences:** Federal Reserve policy uncertainties and geopolitical tensions outweighed positive macro news, encouraging diversified strategies within crypto portfolios.

—

### Conclusion

October 2025 marked an important shift for Bitcoin’s market dynamics. Long-term holders’ tempered selling behavior coupled with cautious institutional demand reflects heightened uncertainty amid complex global factors. While short-term headwinds persist, the underlying data suggests a move toward stabilization, offering cautious optimism for investors navigating the current crypto landscape.

Stay informed to better understand evolving trends and make strategic decisions in this ever-changing market.

https://bitcoinethereumnews.com/bitcoin/bitcoin-long-term-holders-ease-selling-pressure-amid-institutional-weakness-and-global-uncertainty/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-long-term-holders-ease-selling-pressure-amid-institutional-weakness-and-global-uncertainty