Bitcoin Appears Poised for Next Major Move Amid Rare Undervaluation and Strong Liquidity Signals

Bitcoin is currently entering a rare confluence of undervaluation and robust liquidity signals, suggesting that the market may be preparing for its next significant move.

According to data from ecoinometrics, Bitcoin is trading nearly 30% below its Nasdaq 100-implied fair value. Spot prices are hovering near $110,000 compared to an estimated fair value of $156,000. The last time such a wide valuation gap appeared was in 2023, right before a major rally.

Analysts at ecoinometrics noted that unless the current bull market is already over, this discrepancy is likely to narrow as Bitcoin catches up with equities. While Bitcoin has lagged behind tech stocks in recent weeks, its correlation with U.S. indexes remains intact. Bloomberg data indicates this is more of a recalibration than a breakdown, hinting that a rebound could follow once risk appetite returns.

### On-Chain Liquidity Signals Point to Heavy Buyer Interest

On-chain analyst Maartunn shared a chart highlighting that Bitcoin’s Stablecoin Supply Ratio (SSR) Stochastic RSI has dropped into oversold territory—a condition historically associated with heavy liquidity on the sidelines.

“Liquidity is loaded,” Maartunn wrote, noting that the current setup means stablecoin supply is high relative to Bitcoin’s market cap. This is a signal that buyers have ample dry powder ready to enter the market.

### Derivatives Reset and Fresh Market Structure

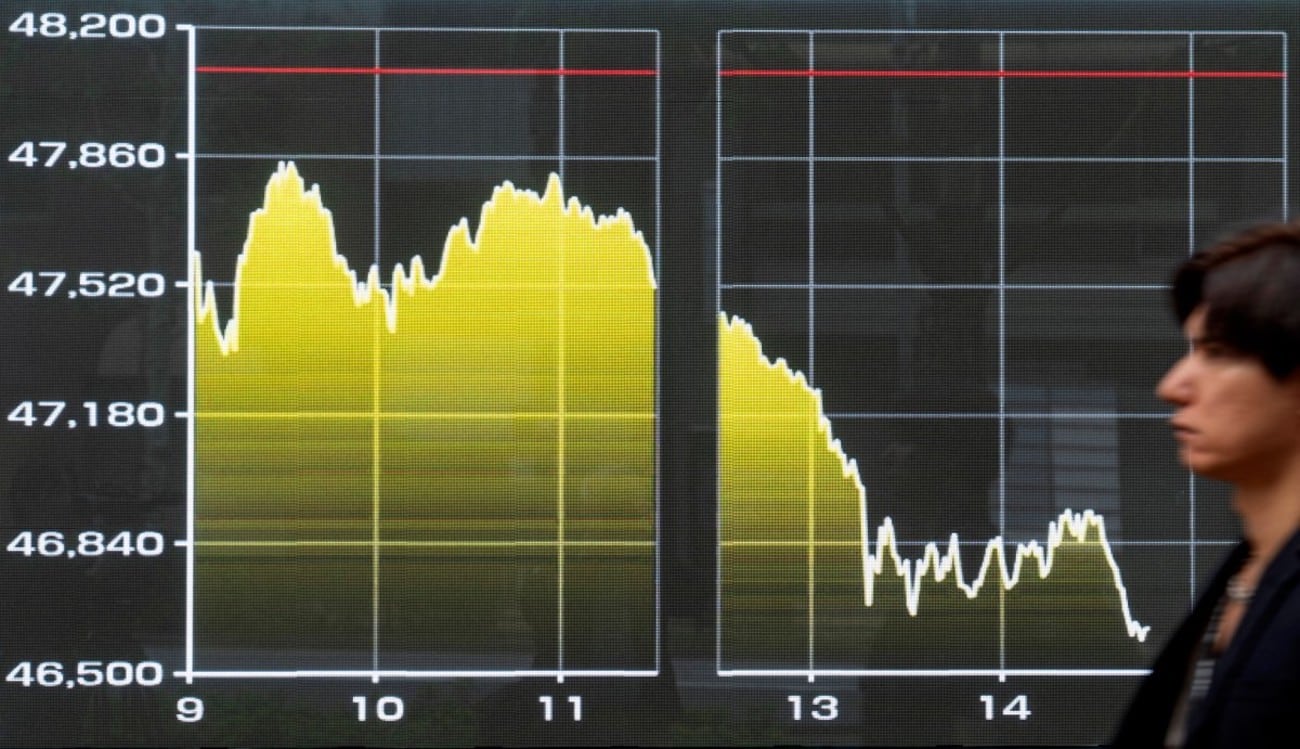

October’s flash crash erased over $12 billion in open interest, marking one of the sharpest derivatives contractions in Bitcoin’s history. Futures open interest plunged from $47 billion to $35 billion as leverage unwound rapidly.

Analysts view this as a constructive development, clearing excessive speculation and paving the way for organic, spot-driven growth. BitMine and Fundstrat’s Tom Lee told CNBC that while this “huge deleveraging event” remains a drag on sentiment, open interest now near record lows combined with strong fundamentals could spur a new rally before year-end.

At the same time, Glassnode data shows options open interest now surpassing futures by roughly $40 billion—a sign that the market is maturing toward defined-risk strategies rather than speculative leverage.

### Gold’s Momentum Fades as Bitcoin Awaits Rotation

Gold’s record-breaking rally appears to be losing steam after its steepest weekly drop in more than a decade. Bloomberg and Reuters report that institutional investors are reassessing the durability of gold’s move, with some beginning to rotate capital toward Bitcoin and other higher-beta assets.

Investor Anthony Pompliano highlighted what he calls a “great rotation” from gold into Bitcoin, noting that Bitcoin tends to trail gold by about 100 days in performance cycles. As gold cools off, Bitcoin’s deep discount relative to equities could attract migrating capital.

### Conditions Align for a Long-Term Breakout

Historically, Bitcoin trading 30% below its Nasdaq fair value has signaled the later stages of accumulation rather than distribution tops. With stablecoin liquidity surging, leverage flushed out, and institutional inflows steady, analysts see the current setup as an opportunity window rather than a warning.

If macro sentiment stabilizes and the rotation from gold gains momentum, Bitcoin could swiftly close its valuation gap and reclaim fair value—a move that past cycles suggest could unfold before the end of the year.

—

*The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.*

—

**About the Author**

Alex is a reporter at Coindoo and an experienced financial journalist and cryptocurrency enthusiast. With over 8 years of experience covering the crypto, blockchain, and fintech industries, he provides insightful and thought-provoking articles on the latest developments and trends. Alex’s approach breaks down complex ideas into accessible, in-depth content to help readers stay on top of the evolving digital asset landscape.

Follow his publications to stay updated on important trends and topics in the market.

https://coindoo.com/bitcoin-trading-30-below-fair-value-liquidity-signals-major-upside-ahead/