Author: admin

Creating sacred vestments with prayer, precision, intention and love

To someone in the pew, it may be just something that a priest or deacon wears during Mass in the colors of the liturgical season. To the priest, what is worn at Mass is a holy garment. Each layer is put on with intention and a prayer. It can reflect so much more than the liturgical season. It can reflect their culture, specific spirituality or charism. Most of us would not think that a priest is too concerned with something “beautiful” to wear for Mass. But, given the eagerness that priests have shown in response to custom vestments by Maria Diplan, thoughts about this are changing. Oratorian Father Johnni do Bonfim Silva, parochial vicar at St. Philip Neri Church in Fort Mill, said that vestments should always reflect the dignity of what is being celebrated.“Custom-made vestments, especially those made at home, are of utmost importance because they are made to my size, and I feel they are something special to wear at holy Mass. Whenever I put on my vestments, I remember the person who made them and pray for her. For liturgy, [it is] always the best,” he said. Having “the best” and appropriately sized vestments for liturgies isn’t necessarily the cheapest endeavor. According to Maria, fabrics can cost up to $300 a yard and only a few companies in the world still have the machinery needed to make certain fabrics in the colors that are specific to the liturgical season. She has personally searched and traveled for the right fabrics, trims and ribbons to be used, and her home studio currently contains material from New York, England, Germany and Italy. For the embroidery, Maria works with a company in Brazil that can customize logos and designs in size, color and shape to the specific needs of vestment. In the end, an extraordinary piece of artistic clothing, rich in symbols and colors made with prayer, love and a feeling of “unworthiness,” she said, are created in the service of something sacred. Maria’s story begins in the Dominican Republic. She was born into a family with 10 children, but her mother had complications following childbirth. Knowing that she might not be able to raise baby Maria, she asked her own sister Enoelia to adopt the baby. Enoelia accepted, and Maria’s mother passed shortly thereafter. Enoelia raised Maria in the Catholic faith and in a ministry of sewing vestments for parish priests. Maria began to learn the art of sewing, and at that time, each stitch of embroidery was done by hand. Lessons in the craft have been learned along the way and while sewing priests’ vestments might seem easy to some, it is much more involved in the customization of each piece of clothing. There’s no fashion design school to teach how to make clerical attire. Enoelia, now 87, has taught Maria much, but even with her childhood training, the seamstress has had to learn most of the skills along the way. She’s now a parishioner of St. Philip Neri, and she shared that priests have been open and honest in communicating what works and what doesn’t even down to types of snaps, pros and cons of Velcro, preferences in fit, fabrics used and more. Precision and attention to detail are of utmost importance to Maria, which is one reason why priests have begun to spread the word on their own about her custom-made vestments. Father Anthony Onoko is pastor at St. John the Baptist Church in Perryopolis, Pennsylvania. He heard about Maria’s work and asked her to create several vestments.“A custom piece carries intention,” Father Onoko said. “It is crafted prayerfully, thoughtfully and with a sense of purpose that readymade vestments simply cannot match. It becomes not just something to wear, but something that accompanies me in worship and a visible expression of sacred service to God. It reminds me of the dignity of the work I do and the responsibility I carry whenever I stand before God’s people.”With modern technology, embroidery is no longer done by hand but by computer software tailored to the machinery. While the Brazilian company has a huge library of designs, Maria continually works with designers in customizing logos, emblems, crosses and religious symbols. When making stoles for the Rock Hill Oratory, Maria sent the Brazilian company the Oratorian logo. They in turn made a digital file for the embroidery machine, and now the priests of the Oratory have stoles with their community logo. Fabrics, ribbon, trim and embroidery design all come from various parts of the world, alongside an individual priest’s ethnicity, culture and spirituality. This makes custom vestments very appealing, with each serving as a testament to the universality of the Catholic Church. Maria has named her company MD Ecclesiastics and hopes to have a website soon to expand the service across the diocese. For now, her motto is, “Whatever God wants.” She knows that for this service to grow, more people would need to be trained and hired. She’s more circumspect about her own service and ministry, however. Maria said she felt “unworthy,” because creating and sewing a garment worn by a priest when he celebrates holy Mass and acts in persona Christi is like clothing Christ himself. For deacons, a long scarf-life vestment worn symbolizing being a servant or messenger of the Church, worn over the left shoulder and fastened at the waistChasuble: poncho-like outer vestment worn by a bishop or priest during Mass or a ceremony; a deacon’s chasuble has stitched sleevesAlb: a white vestment worn by someone serving during Mass or a ceremony, tied with a cincture (cord) at the waistFOR THE ALTARCorporal: Square linen cloth on which the chalice and paten are placed during the MassPurificator: Small rectangular cloth used to cleanse the chalice and paten after CommunionPall: Stiffened square of linen used to cover the chalice Learn moreContact Maria Diplan for vestment inquiries at maria. diplan2@gmail. com.

Kaelin’s Corner: Bootheel Conference Tournament watchlist

Previewing the Bootheel Conference Tournament at Senath-Hornersville, with rankings and watchlists for standout girls and boys teams and players from Portageville, Malden, South Pemiscot, Hayti and more.

Zion Discovery Center in East Zion set to finish primary construction in July 2026

The Zion Discovery Center, a public learning center located along the highway just before Zion National Park’s east entrance, is making progress in its construction, with developers estimating the facility’s main buildings will be completed in July. The Zion Discovery center is set to complete construction in summer 2026. The courtyard and entry gazebos are intentionally placed back and away from the highway, emphasizing the natural approach to the Center. Photos by Ty Gant. “We’re not.

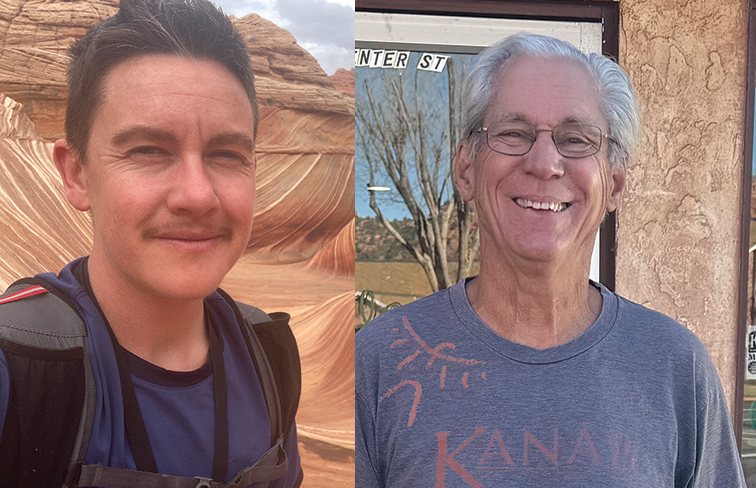

Meet the 2026 Grand-to-Grand local Scholarship recipients

Per their yearly tradition, the organizers of the Grand-to-Grand Ultramarathon have selected two local Kane County area runners to champion local causes and represent in the race. This year’s selected candidates, Ron Thomas and Neak Loucks are taking the opportunity and running with it. Left to right, photos by Ty Gant: “I don’t claim to be a good content creator, but I have a lot of fun,” said Loucks of their instagram, arid_steppe_rat. “Like desert rat, but we’re not really a desert are.

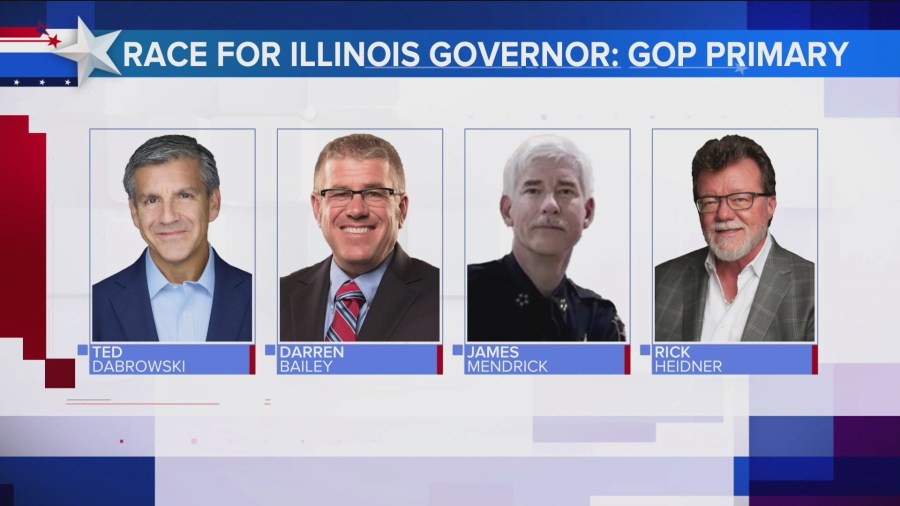

A look at Republican candidates challenging Gov. J.B. Pritzker

Tune in to “The Point” weeknights on WGN at 6:45 p.m.

New York Jets move on from former Steelers linebackers coach

The New York Jets have let former Steelers linebackers coach Aaron Curry go after a disastrous season.

Amazon’s No. 1 bestselling thermal set is 19% off and reviewers say it’s better than Heattech

Stay warm with these warm thermal baselayers from Cuddl Duds while they’re on sale at Kohl’s and Amazon. The moisture-wicking fabric is comfortable, soft and stretchy according to reviews.

Appeals court indefinitely halts judge’s limits on ICE tactics in Minnesota

A federal appeals court on Monday blocked a lower-court judge’s restrictions on Immigration and Customs Enforcement tactics in Minnesota, handing the Trump administration a significant win as protests and legal challenges continue to surround federal immigration operations in the Twin Cities. The 8th U.S. Circuit Court of Appeals issued an indefinite stay of a Jan. […]

Early 2027 commits reflect a changing Husker recruiting era, Geep Wade’s challenge

The transfers from Trae Taylor and Antayvious Ellis to Millard South are more signs of how much the football landscape has changed, even at the prep level.