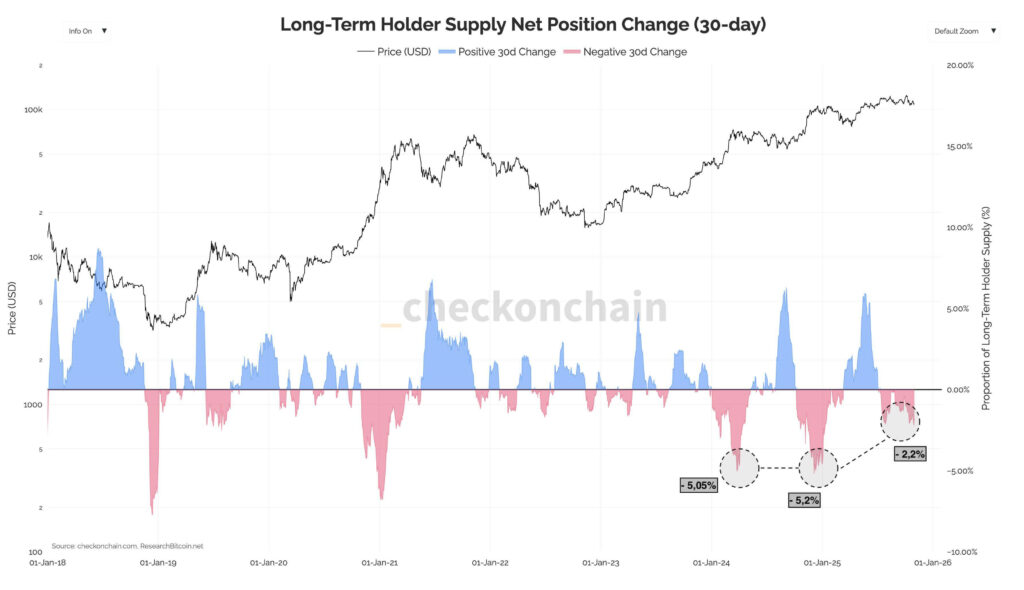

The post Bitcoin Long-Term Holders Ease Selling Pressure Amid Institutional Weakness and Global Uncertainty appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Bitcoin long-term holders reduced their supply by 2. 2% in October 2025, signaling easing selling pressure amid weakened institutional demand and global uncertainties. This moderation contrasts with earlier sharp distributions, potentially stabilizing the market as holders adopt a cautious stance. Long-term holders distributed 330, 000 BTC in October, a softer sell-off than prior months. Institutional demand cooled, with the Coinbase Premium Gap turning negative due to reduced speculative activity. Federal Reserve policy doubts and geopolitical tensions impacted risk assets, despite positive macro developments. Discover how Bitcoin long-term holders are easing selling pressure in October 2025 amid market uncertainties. Explore on-chain data, institutional trends, and future implications for investors. Stay informed on crypto dynamics today. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior traders, research‑backed setups, and risk‑first frameworks. 👉 Join the group → COINOTAG recommends • Professional traders group 📊 Transparent performance, real process Spot strategies with documented months of triple‑digit runs during strong trends; futures plans use defined R: R and sizing. 👉 Get access → COINOTAG recommends • Professional traders group 🧭 Research.